A coffee a day keeps retirement away

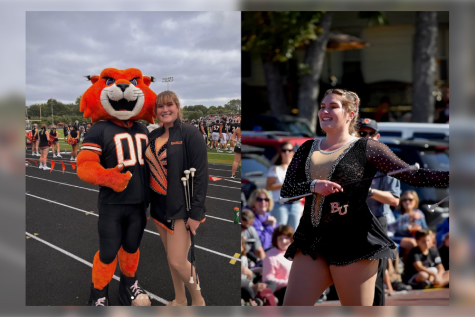

Image by Bailey Horlander.

Some events are so blatantly wrong that they can make my jaw drop. Examples include Frappuccinos, fraternity guys who try to pursue two girls at once, and the coaching decision that led Justin Houston to covering Antonio Brown in the Chiefs’ playoff game last weekend.

Recently, I was most flabbergasted when I read that millennials spend more money on coffee each year than they save for retirement. “Are you shook?” as many of my peers ask these days? I am. You should be.

“According to a recent SurveyMonkey report undertaken on behalf of investing app Acorns, almost half of Millennials have spent more money on coffee than on retirement investing.”

Yikes.

Let me run some facts by you first in case you lack financial knowledge.

A 401(k) or IRA is a type of account employees utilize to contribute portions of their salary to set money aside for retirement.

Obviously the amount you save for retirement will depend on how much you contribute to these accounts. Hypothetically, though, if you added $200 a month to one of these savings accounts starting at age 25 and your friend Paul started doing the same except at age 35, with an interest rate of 6 percent you will have $402,496 by your retirement, and Paul will have $203,118.

To reiterate, you would have nearly twice as much just from 10 extra years of a minimal contribution to retirement.

The results are much more dramatic when you consider higher amounts of monthly contributions.

College students and other young adults obviously thrive by living in the moment. We love to spend on travel, concerts and experiences rather than long-term goods such as furniture and cars. In addition, a huge value our culture has instilled is the right to treat yourself.

For some millennials coffee is just a habit, and a day is not complete without a $5 latte from the artisan shop down the street. But what is the true cost? Five dollars a day on coffee ads up to nearly $2,000 a year.

Obviously, you need to spend money on and do things that make you happy. We live in the YOLO mindset after all. I just wonder if millennials will be happier drinking coffee every day and working until the age of 70+ or saving on the daily expense and retiring to a comfortable home in Naples, Florida, by age 60. I know my personal choice will be lying under the pier on Naples beach.

In addition, coffee is a frivolous expense. It is possible to make high quality French press coffee from home at a lesser cost. However, the massive cash dedicated to coffee instead of savings is a sign of a larger generational problem. Our generation must stop living purely in the moment and consider our long-term happiness. Millennials still can be happy in day-to-day life and plan for a happy retirement simply by cutting out some extra expenses.

The only way to completely take charge is by educating oneself and taking control. Download budgeting applications, read articles on the best places to invest your money, talk to your parents and mentors about how they got to a comfortable place with money.

The reality is this: Frappuccinos are closer to milkshakes than coffee, it usually won’t be worth it to take a chance with a sophomore fraternity guy, and Justin Houston shouldn’t have been left to cover Antonio Brown alone after Houston missed the last two games of regular season.

Finally, saving for retirement is much, much more important than getting a little pleasure from an overpriced cup of coffee each day. Ignorance can be bliss because you are happy in the moment, but knowledge is power and allows you to take steps to be happy for the rest of your life.